Engagement & Retention project | IHX

📍 IHX HISTORY

IHX started 2018 as a digitization product developed by Medi Assist, India’s largest claim processing company (TPA). Initially it was built to serve Medi Assist's extensive network, IHX was created as a payer-tech system to address the inefficiencies in claim origination from hospitals to the TPA. The platform was designed to streamline claims process, reduce manual effort, and improve communication between hospitals and insurers by digitizing claims at the source.

Recognizing the broader potential of the solution, IHX spun out as an independent product company in 2019. This strategic move allowed IHX to extend its innovative solution to other payors, including various insurance companies, while continuing to support Medi Assist.

By doing so, IHX positioned itself as a leading player in the healthcare data exchange space, dedicated to solving complex problems related to claims management and enhancing operational efficiency across the healthcare ecosystem.

🔍 About IHX

www.ihx.in

IHX is India’s largest healthcare data exchange platform. IHX is a B2B SaaS platform. It is used by hospitals in India to submit their Cashless health insurance (HI) claims. IHX happens to be India's largest healthcare claims platform, with 20% of India's cashless claims getting generated on the IHX claims platform.

The company works with large insurance payers like Medi Assist, HDFC Ergo, Aditya Birla Health Insurance, Reliance General Insurance etc. IHX is driving digitization in the Indian health insurance market.

The problem IHX solves has a significant impact on how IHX grows today and monetizes today vis a vis rest of the competition.

IHX competitors i.e. Claim Book an RemediNet are at-least a decade old company. Both started as a SaaS application for the hospitals. Therefore, their functionalities, monetisation model are very different.

IHX is extended by the payor to its network of hospitals.

While doing so, it is the payor or insurer that is incentivising IHX to handle the workload.

In lieu of this transaction fee from the payor, IHX has to onboard the hospitals, keep them active and ensure that majority of cashless/ claim transactions from the payor originate on the platform.

Ofcourse, the payors (TPA and Insurance companies) knew the pain points of the hospitals.

While designing IHX, Medi Assist ensured that some, if not all concerns were taken care of.

Concerns:

1. To manage and track all their cashless pre-authorisation of a claim.

2. Getting access to payment statuses for all claims raised.

3. Day to day MIS.

4. A method for the CXO to get dashboard, to monitor overall cashless.

5. a recent pioneer in product, To automate the claims, through certain inputs from hospitals, ensuring PA is instantaneously approved with compliance from the hospital.

Core Value Proposition

IHX is a one stop solution - for everything insurance.

It solves for digital origination of cashless claims for all hospitals.

It streamlines communication between hospitals and insurers, reducing administrative hassles and ensuring faster, more efficient claims processing through AI/ML capabilities.

The features (sub-products) within IHX ensures to enhance the core value prop.

How do users currently experience the core value prop repeatedly? What is the natural frequency of the product? Does IHX have other sub products? What is their frequency like?

Since IHX is a enterprise soliton, not all modules/sub products are utilised by every user. Each user type performs the core action i.e. their JTBD with the product, however, the frequency for each sub product is mentioned below:

Modules | Feature | Power User | Core User | Casual User |

|---|---|---|---|---|

Claim Submission | Hospitals can upload and submit claims | Yes, Daily | No | No |

Reconciliation | It provides an overview to the user on total cashless transactions | No | Yes, Daily | No |

Claim Automation | It is DIY functionality | Yes, Daily* | No | No |

CXO Dashboard | It represents overall the key biz metrics of the cashless business | No | No | Yes |

- Routine daily tasks like updating claim statuses and managing patient data.

- Continuous engagement with the platform, reinforcing its value.

more on user types, under ICP and user segmentation section...

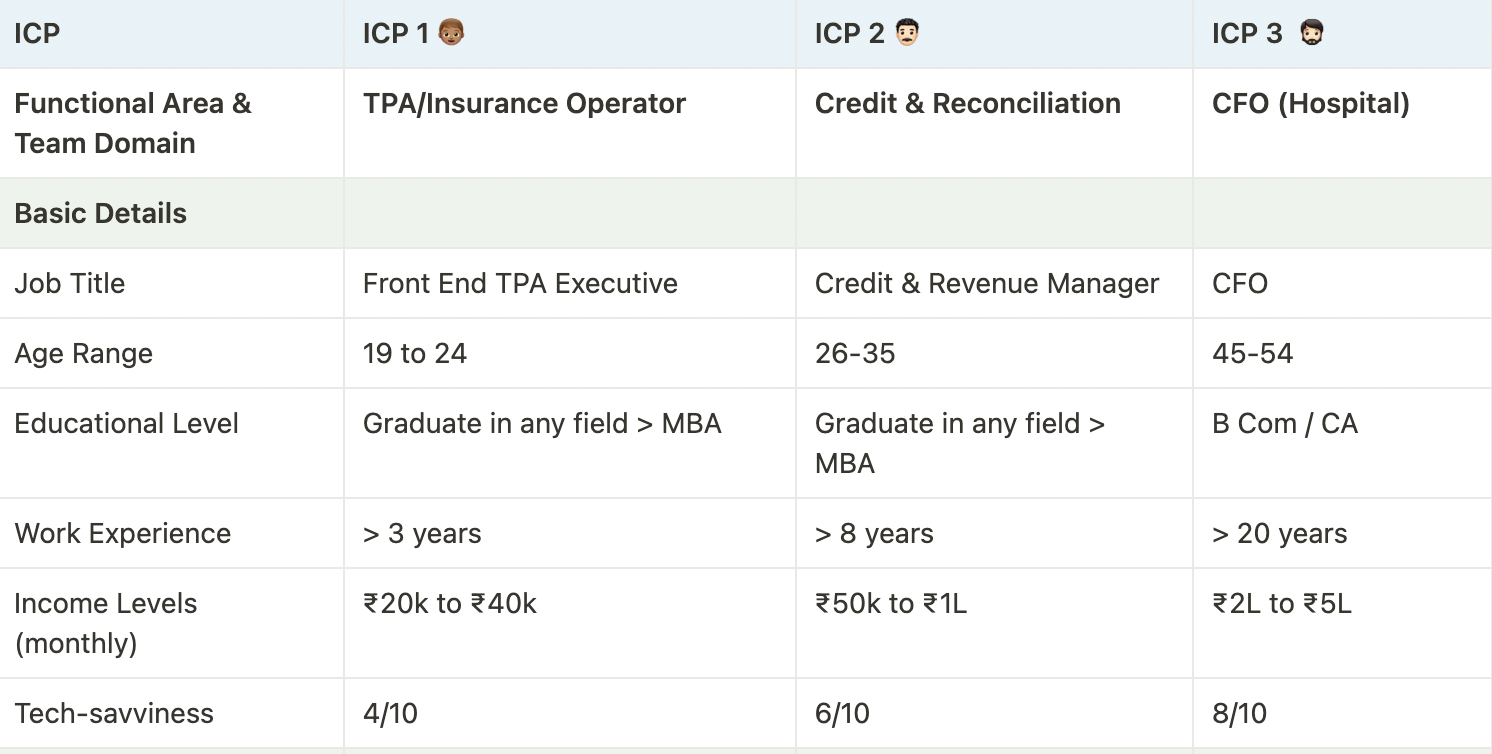

👥 UNDERSTANDING USERS & SEGMENTATION

How to think about user segmentation for IHX

As an enterprise SaaS product, IHX is used by 12500+ hospitals in India to submit Cashless claims to 30+ insurers. This means that a vast diversity of hospitals use the product. From small to very large hospitals, based in metro cities to small towns, single and multi-specialty focused, all types of hospitals are on the IHX platform.

This also means that all their patient-facing teams who deal with insured patients have to mandatorily use the product. Additionally, the internal teams which are part of the finance function have to use the product to track payments for the claims. The larger hospitals may have different departments and teams for each of the job role, but in smaller hospitals, all the roles will converge into one operator and mostly the doctor-owner would manage the finance responsibilities as well.

Basis these considerations, we can think of segmentation in IHX in the following two ways:

1. Segments based on the siez of the hospital - i.e. Enterprise, Mid-Tier and Longtail

2. Segments based on the user type i..e ICP or Power, Core and Casual

1. Based on the size of the hospital

📊 Cohort | Enterprise Hospital | Mid Tier Hospital | Long Tail Hospital |

|---|---|---|---|

Hospital Revenue | 1000 crore + annually | 200 crores + annually | 30 to 50 Cr annually |

Percentage Revenue dependent on Insurance | average 60% to 70% | average 50% | less than 20% |

Cashless insurance - Claim Submitted | 10-30 times a day | 2-5 times a day | 1 to 3 times a month |

Hospital Name (example) | Manipal Group, Fortis, | Belle Vue Hospitals, Kolkata | Shri Laxmi Hospital, Dharwad |

- Based on user personas (for an enterprise and mid tier hospital)

Within, both the segment of the hospital size, there are 3 user types using the product IHX.

| Behavioural Details of the ICPs | ICP 1 👦🏽 | ICP 2 👨🏻🦱 | ICP 3 🧔🏻 |

|---|---|---|---|

Key responsibilities at their daily job? | - Attend to insurance patients - Send their intimations to respective insurance payors (data entry) - track and manage the patients claim journey at the hospital | - manage daily transactions and keep a track of - check bill status and check mismatch - monitor settlement voucher received from payor - | - entirely keep a track of revenue cycle management |

Primary stakeholders they interact | Patients / Caregivers & Payor (Insurance Co + TPA) | Insurance Co (infrequent) for reconciliation of | Hospital leadership & key partners |

What are their primary goals related | - raise a claim (submit) - track progress and share info required - patient in-person assistance (counselling) | - ensure the medical file is shared for every insurance - ensure the balance sheet is matched for credit payors - ensure payor is not deducting any additional money | - ensure the hospital team is able to efficiently manage - ensure the money through credit payors are paid |

Key responsibilities do you have | ensure every cashless insurance patient has a good | ensure to always track, and manage payment received and | ensure money is hit in the bank, timely. |

User Type based on Utilisation of IHX | Power | Core | Casual |

🌟 User Type

| User Type | Use-case | Products/Features Used | Frequency |

| 👊🏻 Power User - ICP 1 (the TPA Executive) | Totally dependent on IHX for day-to-day exchange for claim. Dependent on IHX for tracking status of the claim. It has become an important structure for their efficiency and productivity. | Claims Submission | Multiple times in a day |

| 😇 Core User - ICP 2 (Reconciliation & Credit Manager) | Dependent on IHX for tracking claims and view revenue cycle, but may not require all the advanced features. Their work is important, but they might use only certain modules or features of the system. | Reconciliation | Once a day |

| 👆🏼Casual User - ICP 3 (Operations or Finance Head or CFO) | Not dependent on IHX for any of their OKRs. Might have additional tools such as Hospitals’ HIS for tracking insurance revenue cycle, may use IHX to verify or vet data. | CXO Dashboard | Once in a week |

🎖 Job To Be Done | User Goals

| ICP | Functional Goals | Personal Goals | Financial Goals |

|---|---|---|---|

| ICP 1 | - Ensure all claims are submitted accurately and timely - Track the status of claims efficiently -Minimize manual processes | - Increase productivity - Reduce stress - Achieve recognition | ~ |

| ICP 2 | - Maintain clear visibility of transactions - Automate reconciliation - Access consolidated analytics | - Improve productivity - Gain a sense of accomplishment - Enhance job satisfaction | ~ |

| ICP 3 | - Oversee revenue cycle management - Verify financial data - Ensure alignment with goals | ~ | Optimize cash flow Reduce operational costs |

Actions that makes someone an Active User (across all cohorts i.e. hospital segments based on size)

👊🏻 Power User - number of claims submitted

😇 Core User - number of MIS reports downloaded

👆🏼 Casual User - number of logins to the system

Active Users - Frequency (ex: for an enterprise hospital)

👊🏻 Power User - 30 claims submitted in 1 day

😇 Core User - 2 payors MIS reported downloaded 1 day

👆🏼 Casual User - 1 dashboard login in 1 week

〽️ ENGAGEMENT FRAMEWORK

*Note:

The most value in IHX is for a power user i.e. ICP 1 as they transact and exchange claims in volume through the platform.

Please note, the product itself is designed by nature where one has to use it be default for it primary job.

Hence the framework and further the EnR campaigns are desgined keeping in mind the same.

It does not intent to move a casual user to core and a core user to power user.

Rather, the outcome is to increase App stickiness quotient for each user type and users deriving more value through products.

🫂 ENGAGEMENT CAMPAIGNS

Since the casual, core and power users are defined by their roles and not necessarily by their utilization of features of the platform, our focus of engagement campaigns would be on ensuring higher platform stickiness and delivering consistent value to our users.

Campaign 1️⃣ - Claim Automation

Segment type | By size of hospital |

|---|---|

Audience | Enterprise hospital (large scale) - Power user |

Goal | Create awareness about Claim Automation functionality |

Pitch |

|

Offer | 1:1 call with our Product Specialist |

Frequency | Email

|

Success metric |

|

Solving For | Breadth |

Campaign 2️⃣ - Support Tickets

Today the power users have to escalate all their issues via email. The challenge with the same is that it’s hard for the users to track all the escalations they have submitted and get the status on their resolution. This is a big irritant for the users. Unresolved issues and complaints demotivate users from using the IHX platform.

Support tickets is proposed as a one-single place for users to raise their support issues and track the progress on the same.

Segment type | By size of hospital |

|---|---|

Audience | Enterprise hospital (large scale) - Power user |

Campaign type | New feature launched - Support ticket |

Goal |

|

Pitch |

|

Offer / CTA |

|

Frequency | In product nudges

|

Success metric |

|

Solving For | Breadth |

Campaign 3️⃣ - Cashless Everywhere

Insurance sector regulator IRDAI has launched a new initiative (Cashless Everywhere) from January 2024 through which even if a hospital is not empaneled with an insurer, the insured patient can submit a request for cashless to that insurer and the insurer has to process that cashless request.

This opens up massive opportunity for the hospital to improve patient experience by supporting patients in filing the Cashless Everywhere (CEW) requests for the patients. IHX becomes clearly the default platform of choice that can enable such requests to originate digitally and be processed by insurers tied-up with IHX.

Please note here that while IHX works with 30+ insurers, a hospital may not be empanelled by all the insurers. So the hospital would be using IHX to submit claims to only a few insurers and will be out-of-network for the rest of the insurers on IHX platform.

CEW is proposed as a new feature in IHX to enable power users to originate CEW requests of the patients through IHX platform.

Segment type | By size of hospital |

|---|---|

Audience | Enterprise hospital (large scale) - Power user |

Campaign type | New feature launched - Cashless Everywhere |

Goal |

|

Pitch |

|

Offer |

|

Frequency |

|

Success metric |

|

Solving For | Breadth |

Campaign 4️⃣ - IHX Academy

IHX should create a new User education section Academy on their website (login page as well as within the application). The Academy should host training videos, tutorials and FAQs for self-learning.

The Academy will solve two problems:

(a) Training content will come with evaluation, so IHX as well as the hospital would know the progress on the skills of the operator. Thus the onboarding will be strengthened.

(b) The Academy will issue certification to operators for their level of expertise as practice from using the platform. The certification will ensure better retention of talent within the ecosystem of insurance processing at hospitals and onboarding of future empaneled hospitals will be faster as more certified resources enter the industry.

Segment type | By size of hospital |

|---|---|

Audience | Enterprise hospital (large scale) - Power user |

Goal |

|

Pitch |

|

Offer |

|

Frequency |

|

Success metric |

|

Solving For | Depth and Frequency |

⚓️ RETENTION

Before we get on to Retention, we need to understand Churn as per the segments.

What is Churn in case of IHX?

- For the hospitals, the Enterprise and the mid-tier hospitals are highly dependent on IHX to conduct their insurance business with the insurer/payer due to IHX’ integration with insurer platform. The only segment prone to churn is the long-tail of smaller hospitals. This is because their own capacity is so less and they have the disadvantage of their location (tier 2 or 3 cities), that they may not be attracting a lot of insured patients.

- However, since IHX’s competitors ClaimBook and Remedinet monetize largely through the hospitals and they have hardly any integrations with the insurers, these 2 competitors have very limited marketshare (total of 600-650 hospitals), leaving hospitals heavily reliant on IHX (for the claims of the insurers integrated with IHX).

- So what churns? It’s the staff that churns, and with them goes out the institutional, domain and product knowledge. Or sometimes when the staff is given multiple responsibilities, they tend to reduce usage of IHX and send claims via emails to insurers because they don’t need to fill up online forms in IHX.

Reasons for Churn

At a hospital level

| Involuntary churn | Voluntary churn |

|---|---|

Hospital shuts down | Hospital moves to competitor |

One hospital merges with another | Hospital switches to emails and stops using IHX |

Hospital get de-empaneled (removed from cashless) | Staff finding it hard to learn using the product |

Hospital gets blacklisted by insurers | Technical issues with IHX system |

| Unresolved product or feature concerns |

Negative action metrics to watch out for

Negative action | Metrics to track |

|---|---|

Frequent complaints | - Number of support tickets - Type of complaints |

Claims moving to email/competition | - % claims (of total) coming via email |

Staff training issues | - Infrequent logins during the week/month - Type of claims being submitted online (easier ones will be online and more complex claims will be on email) |

Low usage of features (for enterprise and mid-tier hospitals) | - Infrequent logins to reports and Dashboard sections |

🛟 RESURRECTION

*Note - Once a hospital account has opted to move to a competitor, that means they’ve made up their mind to invest into the competing product (because competitors charge a fee to hospitals). It becomes extremely difficult for IHX to get such accounts back because of the investments hospitals already commit to platforms such as ClaimBook and RemediNet.

Resurrection Campaigns

- IHX has super high retention. It loses accounts either to competition or to a change in the behaviour of the hospital and they start using emails for claim submission (mostlt mid and small tier hospitals only). Primarily Resurrection will focus on bringing back a hospital from email usage to IHX usage and where the staff training is an issue, invest into staff training efforts. There are hardly any other approaches.

- Proactive tactics will aim to remove the reasons for an account to churn, while Reactive tactics will target accounts that have discontinued usage of IHX.

Campaign 1 | Campaign 2 | |

|---|---|---|

Segment/Audience | Large hospital - Power user | Small and Medium hospital |

Type of tactic | Proactive and Reactive tactic | Reactive tactic |

Problem statement | Staff training and adoption issues | Hospital moves to email for its claim submission |

Pitch | - Use IHX Academy to gain better understanding of the product usage | Email campaign: FOMO - “Hey, your claim processing has slowed down due to email submissions. Get on to IHX and get yourself an edge.” - “Your patients are waiting longer for discharge. Junk emails and move to IHX for getting discharge approvals faster.” |

Offer | - Certification for the staff upon successful completion of assessment after training course | - Priority support - Dedicated Relationship manager (only for medium scale hospitals)- |

Frequency and timing | In product nudges: Dashboard notifications, all the time, unless user closes the notification, to reappear next day. - A call to the hospital to arrange staff training within a week of usage coming to zero. | Emails sent on Tuesday 10 AM every week for 3 months |

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore courses by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Course

Advanced Growth Strategy

Core principles to distribution, user onboarding, retention & monetisation.

58 modules

21 hours

Course

Go to Market

Learn to implement lean, balanced & all out GTM strategies while getting stakeholder buy-in.

17 modules

1 hour

Course

Brand Led Growth

Design your brand wedge & implement it across every customer touchpoint.

15 modules

2 hours

Course

Event Led Growth

Design an end to end strategy to create events that drive revenue growth.

48 modules

1 hour

Course

Growth Model Design

Learn how to break down your North Star metric into actionable input levers and prioritise them.

9 modules

1 hour

Course

Building Growth Teams

Learn how to design your team blueprint, attract, hire & retain great talent

24 modules

1 hour

Course

Data Led Growth

Learn the science of RCA & experimentation design to drive real revenue impact.

12 modules

2 hours

Course

Email marketing

Learn how to set up email as a channel and build the 0 → 1 strategy for email marketing

12 modules

1 hour

Course

Partnership Led Growth

Design product integrations & channel partnerships to drive revenue impact.

27 modules

1 hour

Course

Tech for Growth

Learn to ship better products with engineering & take informed trade-offs.

14 modules

2 hours

Crack a new job or a promotion with ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.